Press Release

- LG H&H Co., Ltd. CEO :

- Lee Jung Ae

- Business License Registration No. :

- 107-81-98143

Any unauthorized reproduction, copying or distribution is strictly prohibited.

Copyrights © LG H&H Co., Ltd. All Rights Reserved.

For your beautiful life

For your healthy life

For your Refreshing life

Our vision is to create a culture dedicated in promoting our customers beauty and dreams.

We, LG H&H Co., Ltd., have established the foundation for the transparent corporate governance structure since the establishment of the Holding Company structure of the LG Group in 2003. We promote responsibility and accountability by strengthening our corporate management structure with professional directors. We have several committees under the Board to protect the core values of the B.O.D. operation such as professionalism, independence, and transparency. We monitor the operations of the Board by ensuring that the Board strictly complies with the internal regulation on the operation of the B.O.D. to promote continuous growth of the Company.

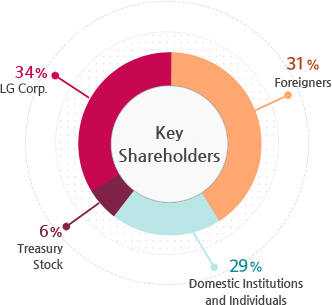

As of the end of 2022, the total number of issued shares(including preferred shares) was

17,717,894. The largest shareholder was LG Corp., which held a 34% stake.

[Common shares*, as of 2022]

* Common shares(15,618,197)

We, LG H&H Co., Ltd., have seven members under the Board of Directors: two inside directors, one other non-executive director, and four independent directors. Our independent directors are experienced professionals from various fields, including business management, law, etc. Our independent directors play active roles in the Board by suggesting opinions on the business management and monitoring major issues in the Company.

| Category | Name | Career | Gender | Position |

|---|---|---|---|---|

| Other Non-executive Director | Beom Jong Ha | (Current) President and CFO, LG Corp. | Male | Chairperson of BOD |

| Inside Director | Jung Ae Lee | (Current) CEO, LG H&H Co., Ltd. | Female | - |

| Hong Ki Kim | (Current) CFO, CRO, LG H&H Co., Ltd. | Male | - | |

| Independent Director | Tae Hee Lee | (Current) Head of Business Affairs, Kookmin University | Male | - |

| Sang Hoon Kim | (Current) Dean of School of Business and College of Business, Seoul National University | Male | - | |

| Woo Yeong Rhee | (Current) Professor, School of Law, Seoul National University | Female | - | |

| Jae Hwan Kim | (Current) Professor, College of Business, Korea University | Male | - |